- プレスリリース

ENECHANGE and Looop establish “JAPAN ENERGY FUND” an overseas-specialized decarbonized energy fund, aiming for 1 billion USD scale investment.

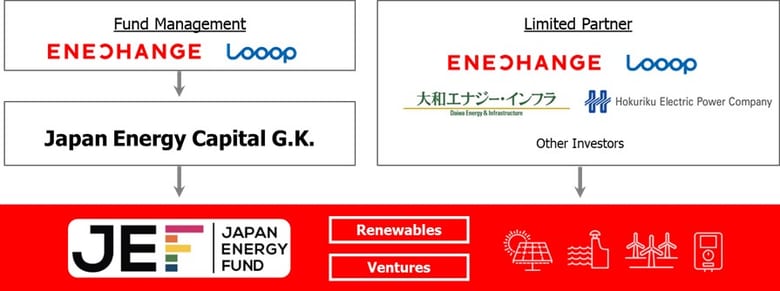

ENECHANGE Ltd. (Head Office: Chiyoda-ku, Tokyo; CEO: Yohei Kiguchi; COO: Ippei Arita) and Looop Inc (Head Office: Taito-ku, Tokyo; President, CEO: Soichiro Nakamura) announce the establishment of “JAPAN ENERGY FUND” (abbreviated as “JEF,” hereinafter referred to as “the Fund”), an overseas-specialized decarbonized energy fund. The Fund seeks domestic and foreign investors to invest in decarbonization and ESG, aiming for a total investment of 1 billion USD.

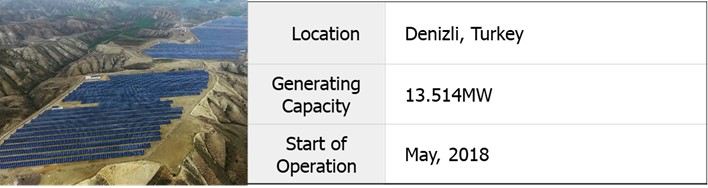

The first fund plans to develop a 100 million US dollar scale business. It will acquire the joint operation right of a 13 MW solar power plant in Denizli Province, Republic of Turkey, through an investment of about 10 million USD. Daiwa Energy & Infrastructure Co. Ltd. (Head office: Chiyoda-ku, Tokyo; President and Representative Director: Morimasa Matsuda) and Hokuriku Electric Power Company (Head office: Toyama City, Toyama Prefecture; President and Representative Director: Yutaka Kanai) have decided to invest in the first fund.

■ Purpose and Investment Policy of JAPAN ENERGY FUND

The Fund aims to realize a sustainable society through “promoting overseas investment in decarbonized energy by Japanese companies.” There are two main axes in the Fund’s initiative: “JEF Renewables” and “JEF Ventures.” The former invests in renewable energy businesses in emerging countries, and the latter invests in energy-based start-ups with advanced technologies in European and North American countries with advanced energy markets. Through these investments, the Fund aims to build a sustainable society focusing on five SDG goals.

The Fund makes “Renewable Energy Investments” based on the following strategy:

Specializing in renewable energy power plants operating in emerging countries

Institutional investors are committed to divestment (withdrawal of investment) in fossil fuels equivalent to 6 trillion USD around the world.The investment in renewable energy was 280 billion USD as of 2017 (up 2% from the previous year), which is being led by emerging countries. Characterised by low energy self-sufficiency and a high need for infrastructure development utilizing renewable energy, the Fund will support sustainable development in these emerging countries through investment in energy infrastructure in close cooperation with the Japanese government, governments of the target countries, and local businesses.In addition, there is an opportunity for improvements to plant operation and management by utilizing our advanced technological capabilities and experiences in data analysis, facility maintenance and inspection we have cultivated in Japan. Therefore we will work to increase the value of these renewable power plants and improve their generation volume and profitability.

The Fund makes “Venture Investments” based on the following strategy:

Collaboration with the Japan Energy Challenge operated by the ENECHANGE Group

In collaboration with the “Japan Energy Challenge,” a European energy venture development program run by ENECHANGE group, we will proactively develop venture companies with advanced technologies in Europe and North America.By investing in decarbonization technologies, we will promote innovation to contribute to Japan’s achievement of decarbonization goals.

■ About JAPAN ENERGY FUND Management Company

The Fund is jointly managed by ENECHANGE and Looop through Japan Energy Capital limited liability company. With the participation of ENECHANGE and Looop as limited partners, the company seeks Japanese and overseas investors and expand its AUM to a total of 1 billion USD. The first fund plans to raise 100 million USD AUM. Hokuriku Electric Power and Daiwa Energy & Infrastructure have decided to participate in this fund.

The roles of the four main companies are as follows:

ENECHANGE: Provision of a platform for energy data analysis technology based on worldwide business experience.

Looop: Detailed examination of power plant projects and provision of technical knowledge based on experience in development and management of renewable energy power plants.

Daiwa Energy & Infrastructure: Provision of financial knowledge based on investment experience in the domestic and overseas energy fields.

Hokuriku Electric Power: Provision of technical knowledge on the operation of power plants based on multi-decade experience as an energy utility.

■ Investment Project in Turkey

The first project of the Fund is the acquisition of a solar power plant operating in Denizli province, Turkey. The plant is located about 300 km south of Istanbul, the capital of Turkey, at an altitude of about 260 m, and has a power generation capacity of about 13 MW. The power plant has a supply capacity of 22.5 GWh, which is equivalent to the annual power supply for about 8,000 Turkish households.* The solar power plant benefits from the Feed in Tariff (FIT) in Turkey which is similar in concept to Japan’s Feed-in Tariff (FIT). The solar powerplant is expected to generate long-term stable income by selling electricity to distribution companies in the region at a fixed price equivalent to US$ 0.133 (13.3 cents) per kWh for ten years. *WorldData.info “Energy consumption in Turkey”

Overview of Electricity Demand in Turkey

Turkey has a total population of over 80 million, about half of which are young people under the age of 32. As the population continues to grow, economic growth and industrial diversification will progress, steadily increasing the demand for electricity. However Turkey has an energy self-sufficiency rate as low as 25% (2016). Therefore we aim to raise the rate of domestically produced renewable energy to 30% by 2023. Solar power generation facilities in operation generate approximately 6 GW, and Turkey participates in international agreements such as the Energy Charter Treaty. Many foreign investors, mainly European companies, have also participated in the renewable energy market, and the investment environment in this field has been well established. The Fund will continue to make additional investments aggressively in Turkey.

Comments from Mr. Hasan Murat Mercan, Ambassador of the Republic of Turkey to Japan

Demand for energy and natural resources has been increasing due to the economic and population growth in Turkey. Over recent years, Turkey has seen the fastest growth in energy demand in the OECD, and according to IEA forecasts, is set to double its energy use over the next decade. Under these circumstances investing in Turkey on the energy sector by Japan Energy Capital is a win-win approach for both sides.

■ Comments from Companies Concerned

Yohei Kiguchi, CEO of ENECHANGE Ltd.

In response to the trend toward investment in decarbonization and ESG, investment and management of operating renewable power plants are expected to grow to trillions of USD, and we were looking for entry opportunities mainly in electric power data analysis technology. We are extremely pleased to enter this field with a high prospect that we will be able to make a 1 billion USD investment through the capital and business alliance with Daiwa Securities Group Inc. Our group is mainly engaged in power data analysis using machine-learning based technologies. In many overseas renewable energy power plants, however, data analysis is not yet fully implemented. Our data analysis capabilities in these renewable power plants have great potential for our overseas business to leap forward.

Soichiro Nakamura, President and CEO of Looop Inc

It’s great to start our JEF investment activity in Turkey. It has a tremendous market size and growth potential. People need renewable energy there. And the government offers a very good investment environment. Our work to promote renewable energy will be a significant example of bilateral collaboration in the private sector in Turkey and Japan. So it’s my pleasure and I will make my every effort as Asset Manager to ensure a successful outcome in Turkey, and in other future JEF opportunities.

■ JAPAN ENERGY FUND Overview

| Fund Name | Japan Energy Capital 1 L.P.

Commonly known as JAPAN ENERGY FUND (JEF) |

| Date of Establishment | December 6, 2019 |

| Investment Method | Capital call method |

| Investment target |

|

| Fund Size | 100 million US dollar scale |

| Operation Period | Until December 2029 |

| Unlimited Liability Partner | Japan Energy Capital G.K. |

| Limited Liability Partners

※As of April 21, 2020 |

|