Corporate Governance Policy

With the mission of “Changing Energy for a Better World,” the Company group (the “Group”) is promoting Green Transformation (GX) towards achieving a decarbonized society (carbon neutrality), a global challenge. To realize a decarbonized society, effective methods include (i) decarbonizing the power grid, (ii) electrifying transportation, (iii) improving food, (iv) conserving nature, (v) purifying manufacturing, and (vi) removing carbon dioxide. The Group, under the mission of “Changing Energy for a Better World,” aims to become a category leader in the energy tech domain by developing businesses that contribute to (i) decarbonizing the power grid and (ii) electrifying transportation.

To fulfill this mission, the Group conducts corporate activities while ensuring that all Directors and employees comply with laws, regulations, and the Articles of Incorporation, and perform their duties under the ENECHANGE Group Charter of Corporate Behavior to enhance management efficiency and transparency, achieve sustainable growth, and maximize corporate value.

Governance Structure and Initiatives

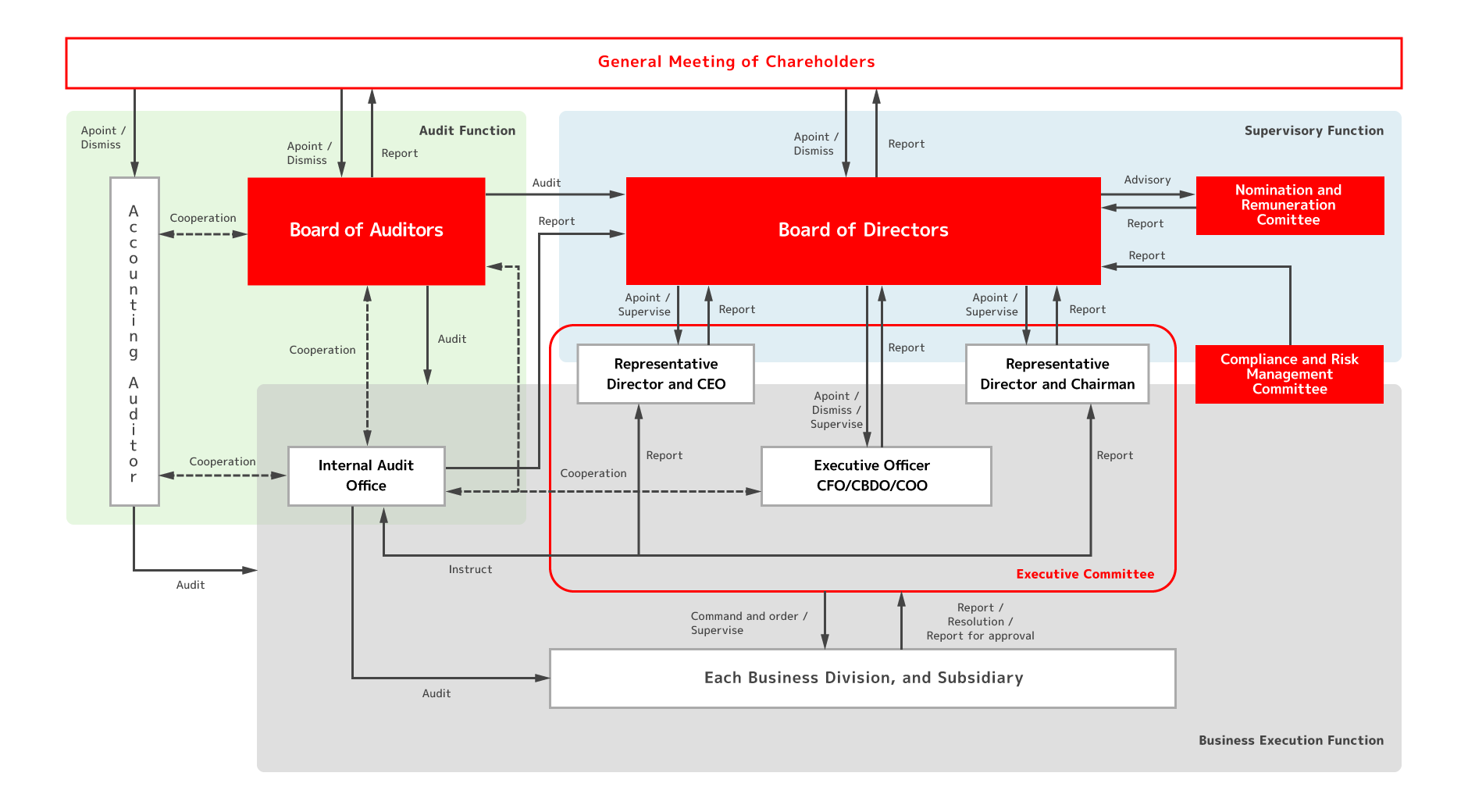

Organization Chart

Details of the Company’s Organization

The Company has established the General Meeting of Shareholders, Board of Directors, and Board of Corporate Auditors as corporate bodies under the Companies Act.

The Board of Directors makes decisions on important management matters and supervises the execution of business duties by Directors. We have established the Board of Corporate Auditors because we believe that a system in which corporate auditors monitor the execution of duties by directors independently is an effective way to strengthen corporate governance. In addition, we have introduced an executive officer system to strengthen the decision-making and oversight functions of the Board of Directors and to separate and streamline business execution.

Board of Directors

The Board of Directors is composed of all directors and, in principle, holds regular board meetings twice a quarter. Additional meetings are held as needed. The board makes resolutions on matters stipulated by laws and regulations, as well as those defined in the Board of Directors’ criteria and the Bylaws on Authority. Auditors attend the board meetings and conduct audits of the directors’ business execution.

Board of Corporate Auditors

The Company adopts the Board of Corporate Auditors system. The Board of Corporate Auditors consists of one Full-time and two Part-time Corporate Auditors, all of whom are Outside Corporate Auditors. In principle, the Board of Corporate Auditors meets once a month, with additional meetings held as necessary. Full-time Corporate Auditor monitors the execution of duties by Directors by attending important internal meetings such as the Executive Committee, inspecting important documents, and conducting other audit procedures. In addition, the Board of Corporate Auditors strives to improve its auditing function by collecting information through exchanging opinions with Representative Directors, Outside Directors, Financial Auditor, and internal audit staff.

Executive Committee

The Executive Committee, attended by Directors (excluding Outside Directors), Executive Officers, and Full-time Corporate Auditor, meets once a week to confirm the progress of business activities, share issues, and make executive decisions in a flexible manner.

Compliance and Risk Management Committee

To recognize the risks surrounding the Group and respond to them appropriately, the Company has established the Compliance and Risk Management Committee, which consists of Representative Directors, Executive Officer, Division Managers, Auditors, and the Internal Audit.

This committee is scheduled to meet once per quarter in principle. The Compliance and Risk Management Committee aims to share the necessary information for risk management of our company and its subsidiaries, promote compliance efforts, and swiftly respond to, investigate, and formulate measures to prevent recurrence of compliance violations.

This organization is primarily aimed at introducing risk assessment and monitoring countermeasures, verifying the risk management system and transactions with related parties, planning compliance education, and monitoring and proposing measures to prevent recurrence.

Internal Audit Office

The Company has established the Internal Audit Office as a department directly reporting to the Representative Director to ensure the efficiency, legality, and soundness of the management of the entire Group. Given that the Company is a small organization, the Internal Audit Office does not have dedicated personnel. The Head of the Internal Audit Office concurrently holds the positions of Head of the Legal and Human Resources Departments. An external collaborator, contracted as an internal audit assistant, conducts audits for departments other than the Legal and Human Resources Departments. To avoid self-auditing, the external collaborator is responsible for internal audits of the Legal and Human Resources Departments. This two-person team audits the status of the entire Group. Furthermore, according to the Internal Audit Regulations, the Head of the Internal Audit Office may appoint internal audit assistants with the approval of the Representative Director as necessary. The Internal Audit Office conducts internal audits based on an audit plan, targeting all divisions and subsidiaries of the Company, and reports the results to the Representative Director and the audited departments. It also reports the audit status to the Corporate Auditors.

Nomination and Remuneration Committee

The Company has established a voluntary Nomination and Remuneration Committee as an advisory body to the Board of Directors for the purpose of strengthening the independence, objectivity and accountability of the Board of Directors’ functions, further enhancing the Group’s corporate governance system by ensuring the transparency and objectivity of the evaluation and decision-making processes related to the nomination and remuneration of the Board of Directors. The Nomination and Remuneration Committee reports to the Board of Directors on matters such as the composition of the Board of Directors, individual nominations of Directors, and drafts concerning the composition, level, and maximum total amount of remuneration for Directors.

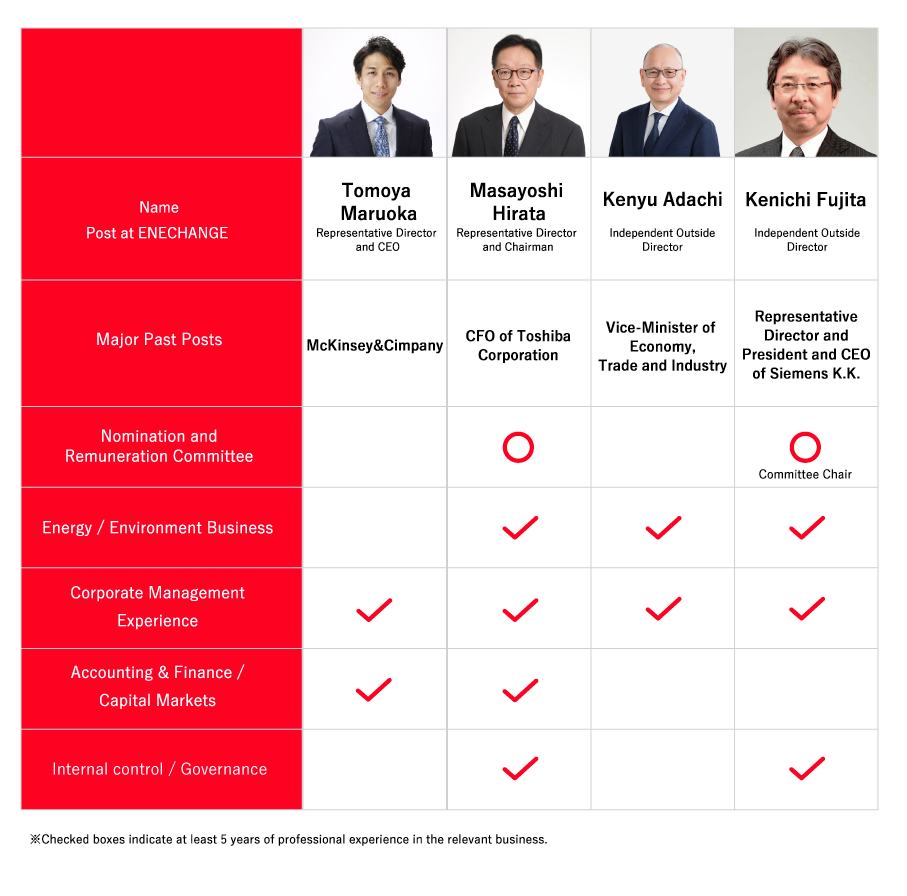

The committee currently consists of Representative Director and Chairman Masayoshi Hirata, Independent Outside Directors Kenichi Fujita. Chair of the committee is Kenichi Fujita.

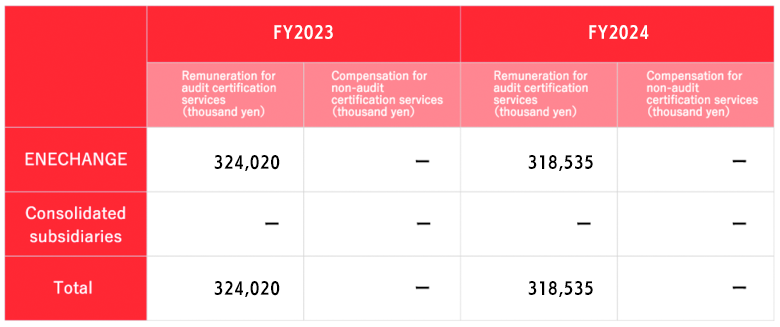

Financial Auditor

The company had an audit agreement with KPMG AZSA LLC, but as disclosed in the notice “Notice Concerning Change of Certified Public Accountants” dated July 29, 2024, KPMG AZSA LLC terminated the audit agreement on the same date and resigned as our company’s auditor. Subsequently, as disclosed on July 30, the audit firm Avantia was appointed as interim auditor at our company’s audit committee meeting held on the same day, and was formally appointed as our company’s auditor at the extraordinary shareholders meeting held on September 3, 2024. Currently, timely and appropriate audits are being conducted based on the audit agreement with this firm.

Skill Matrix of Directors

We have established governance by outside directors with management experience at listed companies in the energy industry. Each director is selected based on their expertise in their respective fields, including experience in the energy industry and finance-related fields.

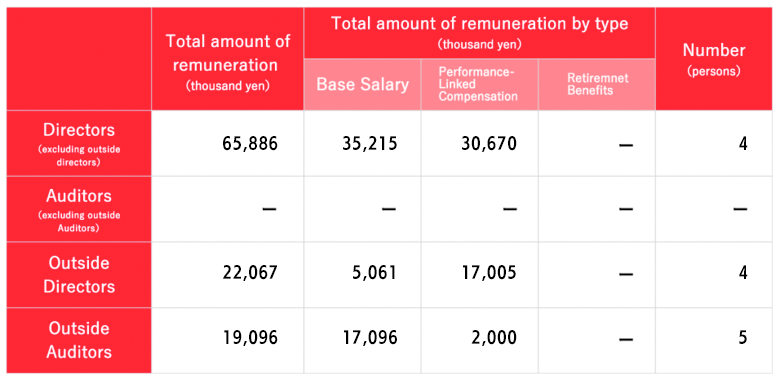

Executive Compensation

Process for Determining Remuneration

The Company has established a policy regarding the determination of the amount of remuneration, etc., of officers and the method of calculating such amount, which consists of basic remuneration and bonuses. Based on this policy, the Company sets the upper limit of the total amount of remuneration for officers by a resolution of the General Meeting of Shareholders, and within this limit, the Nomination and Compensation Committee, an advisory body to the Board of Directors, deliberates and determines the amount to be paid based on the report of the Nomination and Compensation Committee. Basic remuneration is determined as compensation for the execution of duties by the Directors in accordance with their position and contribution to the Company’s business, taking into consideration such factors as industry standards and the Company’s business performance.

Details of compensation for executives in fiscal 2024

Accounting Audit Compensation

Details of Remuneration for Auditing Certified Public Accountants, etc. in Fiscal 2024

Risk Management and Compliance

Anti-Corruption Policy

In accordance with our compliance policy, we will always strive to improve trust in our company through fair, transparent, and free competition.

We will not engage in any form of corruption, whether directly or indirectly, including but not limited to bribery, kickbacks, inappropriate entertainment gifts, illegal political contributions, donations, and sponsorships.