- Press Release

ENECHANGE announces investment in Leap, provider of an energy market access platform designed for distributed energy resources

ENECHANGE Ltd. (Head Office: Chiyoda-ku, Tokyo; Representative Director & CEO: Yohei Kiguchi; Representative Director & COO: Ippei Arita) is pleased to announce that it has invested in Leapfrog Power, Inc. (“Leap”) through an overseas-focused decarbonized tech fund managed by the Japan Energy Fund (JEF).

In their recent Series B round, Leap raised USD 33.5M (approximately JPY 3.7B)*1, which was led by Park West Asset Management (US investment firm), followed by Climate Capital, Union Square Ventures, Congruent Ventures, National Grid Partners, and more.

*1 USD 1 = JPY 110

Source: Leap

Background

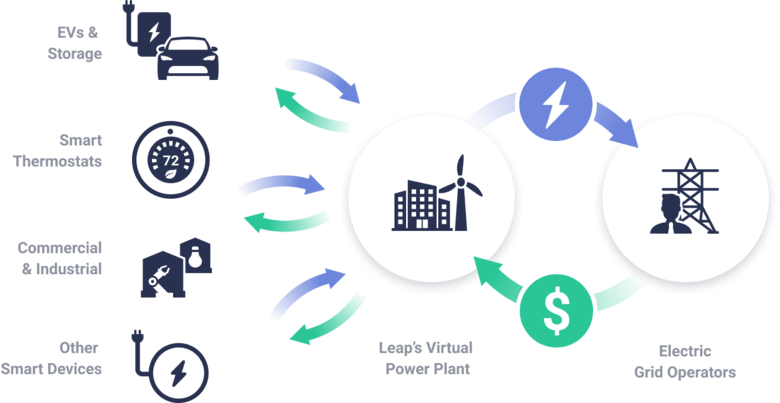

Japan’s journey to net-zero is accompanied by widespread policy reforms in the energy sector, which will go into effect between 2016-2024. By 2024, both the new capacity market and balancing market are expected to be fully open and implemented. Additionally, as detailed in the Japanese government’s Green Growth Strategy, there will be an increase in renewable energy sources in the country’s energy mix by 2050, which are cleaner but less predictable than traditional fossil fuels. Hence, there is a growing need for effective grid balancing solutions. We believe Leap is a strong contender in this field as partners like Stem, Inc. use Leap’s solution, enabling smart energy devices to respond to market pricing signals that reflect the needs of the grid. This empowers these devices to provide stability to the grid while enabling new revenue streams for asset owners. By aggregating flexible loads from a wide array of distributed energy resources (DERs) to support the grid, Leap accelerates the ability to phase out the more expensive fossil fuel-powered peaker plants the grid currently relies on. ENECHANGE is strongly committed to advancing the 4Ds of Energy (Decarbonization, Digitalization, Decentralisation, and Deregulation) in Japan, and believes Leap’s solutions are a promising development on the road to full decarbonization.

About Leap’s Energy Market Access Platform

Leap’s platform enables DERs to easily participate in energy markets. Working with the technology and service providers who manage and operate grid-connected devices, Leap automates energy market access and creates new value streams for its partners and their customers. Via Leap’s Universal API and single point of entry, Leap’s partners can connect devices of any type and load size to a wide array of revenue generation opportunities.

About Leap

Leap is the leading global platform for generating new value from grid-connected resources and devices through integration with energy markets. Leap does all of the heavy lifting, seamlessly connecting technology partners to high-value revenue streams and providing a simplified, automated access point for market participation with batteries, electric vehicle charging, smart thermostats, HVAC systems, industrial facilities, and other flexible assets. By making it easy for new distributed resources to participate in energy markets, Leap lays the groundwork for virtual power plants (VPP). Leap empowers its partners to provide resilient, zero-carbon capacity to the grid while strengthening engagement with their customers through new value streams. Leap is a privately held company with offices in San Francisco and the Netherlands. Since its foundation, Leap has raised 44.1M USD (JPY 4.85 B) *2in total, including funding received from Elemental Excelerator and Powerhouse Ventures.

Website:https://leap.energy

*2 USD 1 = JPY 110

Comments

Yohei Kiguchi, Founder and CEO of Japan Energy Fund and ENECHANGE Ltd.

“We are excited to invest in Leap, whose innovative technology is helping more parties participate in balancing the grid. ENECHANGE is committed to realizing the 4Ds of Energy, and Leap’s solutions further advance digitalization, decentralization, and decarbonization in the sector. Leap’s technology has proven itself through their partnerships with companies such as Stem, Inc., and we look forward to seeing them develop further.”

Thomas Folker, Leap CEO

“This new investment will help us scale our platform and unlock more opportunities for distributed energy resources to participate in grid services programs. We’re thrilled that ENECHANGE and Japan Energy Fund share our vision of creating resilient and decarbonized electricity grids, and we’re looking forward to exploring the opportunity to expand our solutions into Japanese energy markets.”

Japan Energy Fund – Objectives and Investment Policy

Backed by prominent Japanese companies, the Fund aims to build a sustainable society through investment in innovative international companies with technologies related to decarbonization. There are two main axes in the Fund’s initiative: JEF Renewables and JEF Ventures. The former invests in renewable energy businesses in emerging countries, and the latter invests in energy-based start-ups with advanced technologies in European and North American countries with advanced energy markets. Through these investments, the Fund aims to build a sustainable society focusing on five SDG goals.

Website: https://japanenergy.fund

The Fund makes Renewable Energy Investments based on the following strategy:

Specializing in renewable energy power plants operating in emerging countries

Institutional investors are committed to divestment in fossil fuels equivalent to 6 trillion USD around the world. The investment in renewable energy was 280 billion USD as of 2017 (up 2% from the previous year) and is being led by emerging countries. Characterized by low energy self-sufficiency and a high need for infrastructure development utilizing renewable energy, the Fund will support sustainable development in these emerging countries through investment in energy infrastructure in close cooperation with the Japanese government, governments of the target countries, and local businesses.

The Fund makes Venture Investments based on the following strategy:

Collaboration with the ENECHANGE Insight Ventures operated by the ENECHANGE Group

In collaboration with ENECHANGE Insight Ventures, an energy venture development program run by the ENECHANGE Group, we will proactively develop commercial relationships with venture companies with advanced technologies in Europe and North America. By investing in decarbonization technologies, we will promote innovation to contribute to Japan’s achievement of decarbonization goals.

Japan Energy Fund – Summary

| Fund Name | Japan Energy Capital 1 L.P. (“Japan Energy Fund” (JEF)) |

| Date of establishment | December 6, 2019 |

| Investment method | Capital call method |

| Investment target |

|

| Fund size | 100 million US dollar |

| Operation period | Until December 2029 |

| General Partner | Japan Energy Capital limited liability company |

| Limited Partners *As of 29 November 2021 |

|

About ENECHANGE Ltd.

ENECHANGE is an energy technology company with the mission of Changing Energy For A Better World, and promotes a carbon-free society through digital technology. Founded in 2015 and listed on the Tokyo Stock Exchange Mothers in 2020 (securities code: 4169), ENECHANGE works in the 4Ds of Energy: Deregulation, Digitalization, Decarbonization, and Decentralization. We offer a range of SaaS solutions for energy companies and are experiencing rapid growth. Our company’s roots come from an energy data lab at the University of Cambridge, U.K., a country where liberalization is mature. ENECHANGE has a U.K. subsidiary, SMAP Energy Limited, which has developed analytical technology for energy data and provides us with links to a global network.

URL :https://enechange.co.jp/en

■For press inquiries, please contact

ENECHANGE Ltd. Public Relations: Tokiko Nakata, Yumi Ota

Mail:pr@enechange.co.jp